RBKC’s Budget and Council Tax Requirement for 2022/23

The Council will spend £424 million in 2022/23 on a wide range of local services such as:

- social care

- the environment

- leisure facilities

- highways

- transport services

- education and skills development

The charts and table below show the full breakdown of the budget (this excludes Housing Benefit payments and dedicated schools grant which are reimbursed by Government).

| 2021-22 | 2022-23 | |||

|---|---|---|---|---|

| Net £million | Spend £million | Income £million | Net £million | |

| Adult Social Care | 39.6 | 69.3 | -30.6 | 38.6 |

| Public Health | 0 | 21.9 | -21.9 | 0 |

| Children Services | 41.5 | 140.6 | -98 | 42.6 |

| Environment and Communities | 25.1 | 99.7 | -75.2 | 24.5 |

| Housing and Social Investment | 8.5 | 60.3 | -49.4 | 10.9 |

| Resources and Customer Delivery | 29.3 | 203.2 | -171.5 | 31.6 |

| Grenfell Recovery | 10.5 | 9.5 | 9.5 | |

| Total Service Costs | 154.5 | 604.6 | -446.7 | 157.9 |

| Levies | 11.3 | 9.2 | 0 | 9.2 |

| Corporate Contingency | 5.2 | 5.3 | 0 | 5.3 |

| Pay - NI and national pay settlement | -1.7 | 3.3 | 0 | 3.3 |

| Social Care pressures and reforms | 0 | 5 | 0 | 5 |

| Inflation and other economic pressures | 4 | 4,6 | 0 | 4.6 |

| Corporate Items | -2.6 | -0.5 | -2.4 | -2.9 |

| Covid-19 Recovery Framework | 8 | 0 | 0 | 0 |

| Transfer from reserves | -9.4 | 0 | -8.2 | -8.2 |

| Budget Requirements | 169.2 | 631.5 | -457.4 | 174.1 |

| Social Care Grant and New Homes Bonus | -6.9 | 0 | -13.4 | -13.4 |

| Additional Covid-19 funding | -7.4 | 0 | 0 | 0 |

| Retained business rates (including revenue support grant) | -63.9 | 0 | -64.3 | -64.3 |

| Collection Fund Adjustment | 2.7 | 0 | -0.4 | -0.4 |

| Total External Funding | -75.4 | 0 | -78.1 | -78.1 |

| Council Tax Requirement | -93.8 | -96 | ||

| Council Tax base | 97 | 97.9 | ||

| 2021-22 Net £ | 2022-23 Net £ | |

|---|---|---|

| Council Tax per Band D Excluding Garden Square levies | 949.94 | 968.88 |

| Greater London Authority Precept | 363.66 | 395.59 |

| Total Band D council tax | 1,313.60 | 1,364.47 |

| Council Tax per Band D with Garden Square levies | 967.32 | 986.61 |

| Greater London Authority Precept | 363.66 | 395.59 |

| Total Band D Council Tax | 1,330.98 | 1,382.20 |

The Council Tax requirement

The Council Tax requirement after taking into account all income and Government funding is £96.0 million. This is an increase of £2.1 million from 2021/22 broken down as follows:

| Budget Change | £million |

|---|---|

| Inflation and London Living Wage | 7,163 |

| Social Care pressure & Reform | 5,000 |

| Increase in External Funding | (6,902) |

| Service Pressures | 6,657 |

| Service Savings | (4,772) |

| Corporate Budget Reductions | (1,993) |

| Reduction and Collection Fund surplus | (3,151) |

| Other | 145 |

| Total Change funded by increase in Council Tax income | 2,147 |

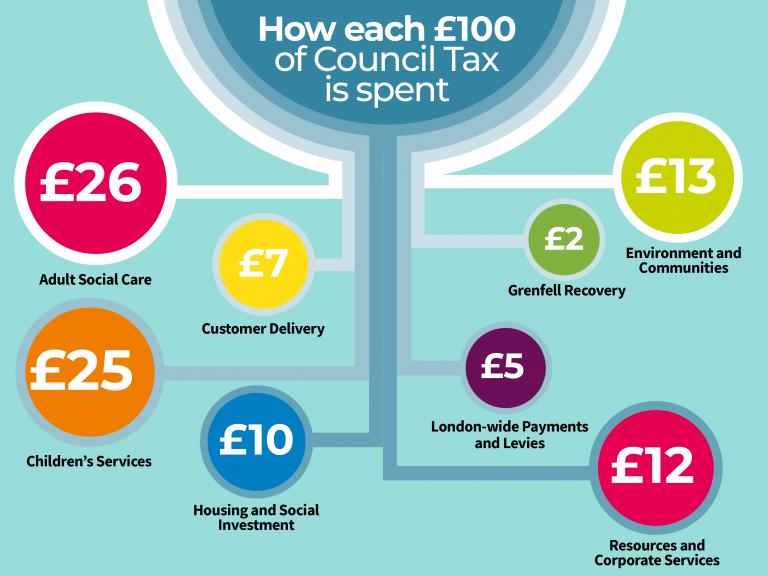

What the Council Spends on

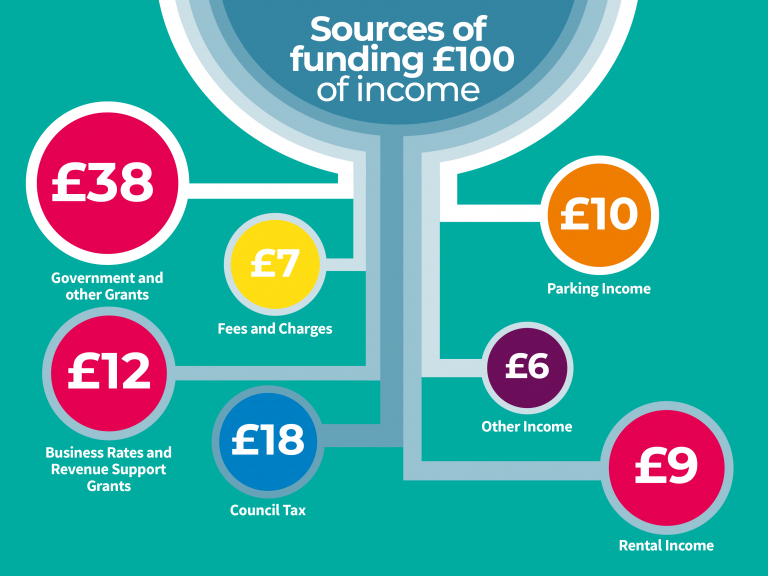

How is it paid for?

Council Tax is just one source of the Council’s income. The chart below shows sources of funding per £100 of income:

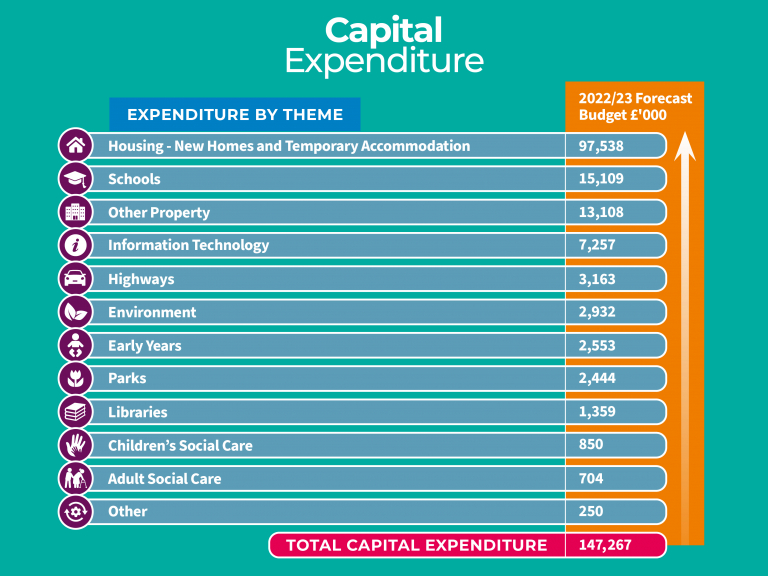

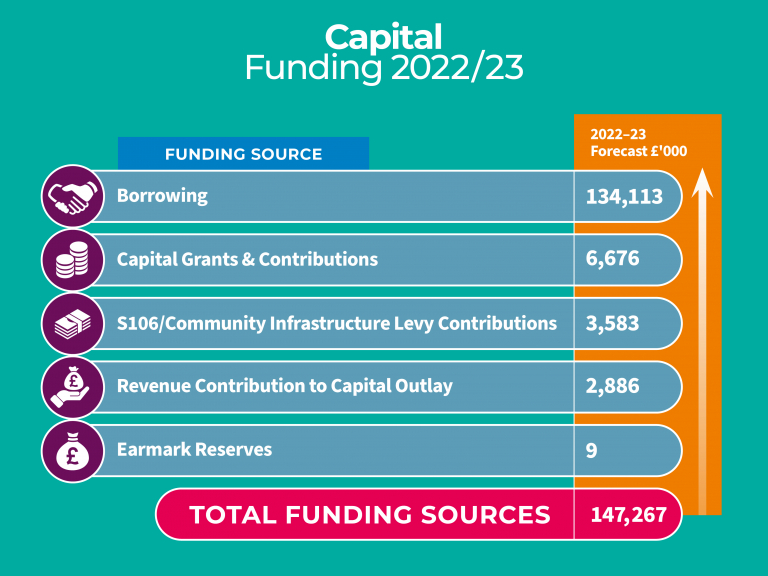

Capital Expenditure – Investment into the borough’s homes, roads, schools, leisure facilities.

Looking beyond 2022/23

The Council has set a balanced budget for the 2022/23 financial year, however there are many challenges ahead. The forecasted budget gap is set to reach between £20m and £30m over the three years from 2023/24 depending on the future of Government grants and funding. Further details on how the Council is addressing these challenges, our pressures and risks over the next few years. are set out in the budget report.